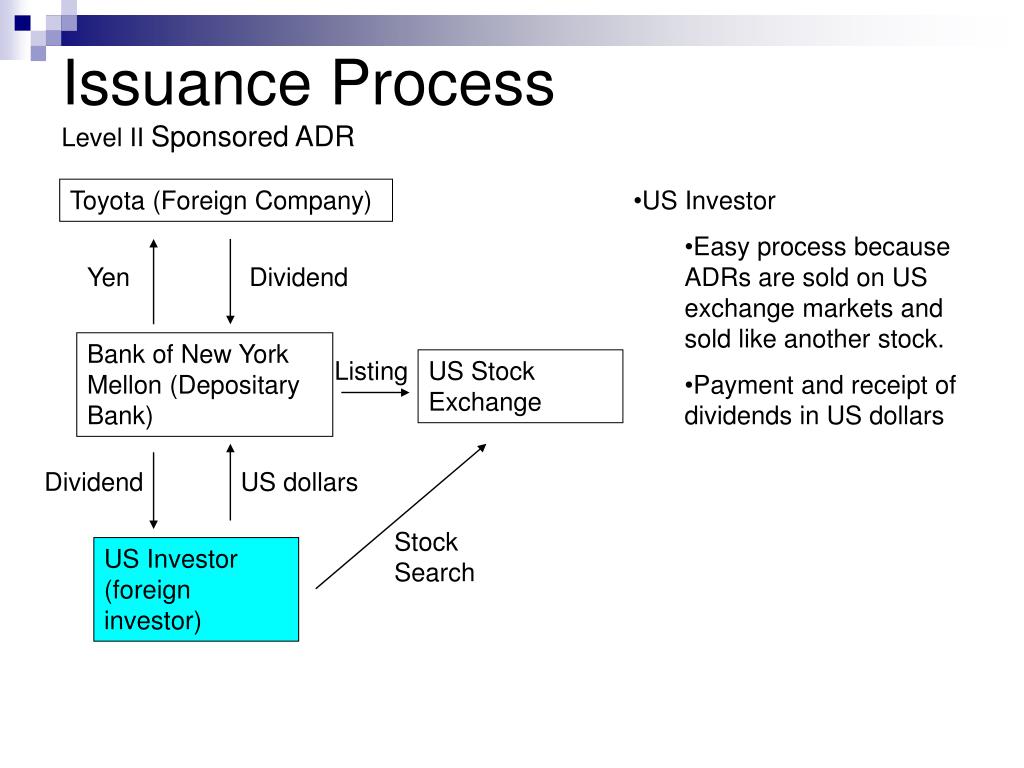

Since the company is not formally involved in an unsponsored issue, the motivation of the company to list overseas is irrelevant for unsponsored programs. Each depositary services only the ADRs it has issued. Unsponsored ADRs are often issued by more than one depositary bank. These shares are issued in accordance with market demand, and the foreign company has no formal agreement with a depositary bank. Unsponsored shares trade on the over-the-counter (OTC) market. For this reason, there are different types of programs, or facilities, that a company can choose. When a company establishes an ADR program, it must decide what exactly it wants out of the program, and how much time, effort, and other resources they are willing to commit. Depositary banks have various responsibilities to DR holders and to the issuing foreign company the DR represents. In the case of companies domiciled in the United Kingdom, creation of ADRs attracts a 1.5% creation fee this creation fee is different than stamp duty reserve tax charge by the UK government. The price of a DR generally tracks the price of the foreign security in its home market, adjusted for the ratio of DRs to foreign company shares. The holder of a DR has the right to obtain the underlying foreign security that the DR represents, but investors usually find it more convenient to own the DR. An ADR can represent a fraction of a share, a single share, or multiple shares of a foreign security. Įach ADR is issued by a domestic custodian bank when the underlying shares are deposited in a foreign depositary bank, usually by a broker who has purchased the shares in the open market local to the foreign company. Companies may choose to issue depository receipts in another jurisdiction for a host of commercial reasons including signalling to their investors and clients about their enhanced corporate governance standard. DRs enable domestic investors to buy securities of foreign companies without the accompanying risks or inconveniences of cross-border and cross-currency transactions.

2.4 Sponsored Level III ADRs ("offering" facility).

Securities of a foreign company that are represented by an ADR are called American depositary shares ( ADSs). equivalent of a global depository receipt (GDR).

Morgan in 1927 for the British retailer Selfridges on the New York Curb Exchange, the American Stock Exchange's precursor. ADRs simplify investing in foreign securities by having the depositary bank "manage all custody, currency and local taxes issues". dollars, and may be traded like regular shares of stock. stock exchanges through ADRs, which are denominated and pay dividends in U.S. An American depositary receipt ( ADR, and sometimes spelled depository) is a negotiable security that represents securities of a foreign company and allows that company's shares to trade in the U.S.

0 kommentar(er)

0 kommentar(er)